Introduction – The Next Battle for the Living Room

For a decade, the “living room” was the one territory social media businesses couldn’t quite conquer. While they owned our commutes, our coffee breaks, and our bedside tables, the largest screen in the house remained the domain of Netflix, HBO, and traditional broadcast. But as we move through 2026, the walls of the living room have finally been breached.

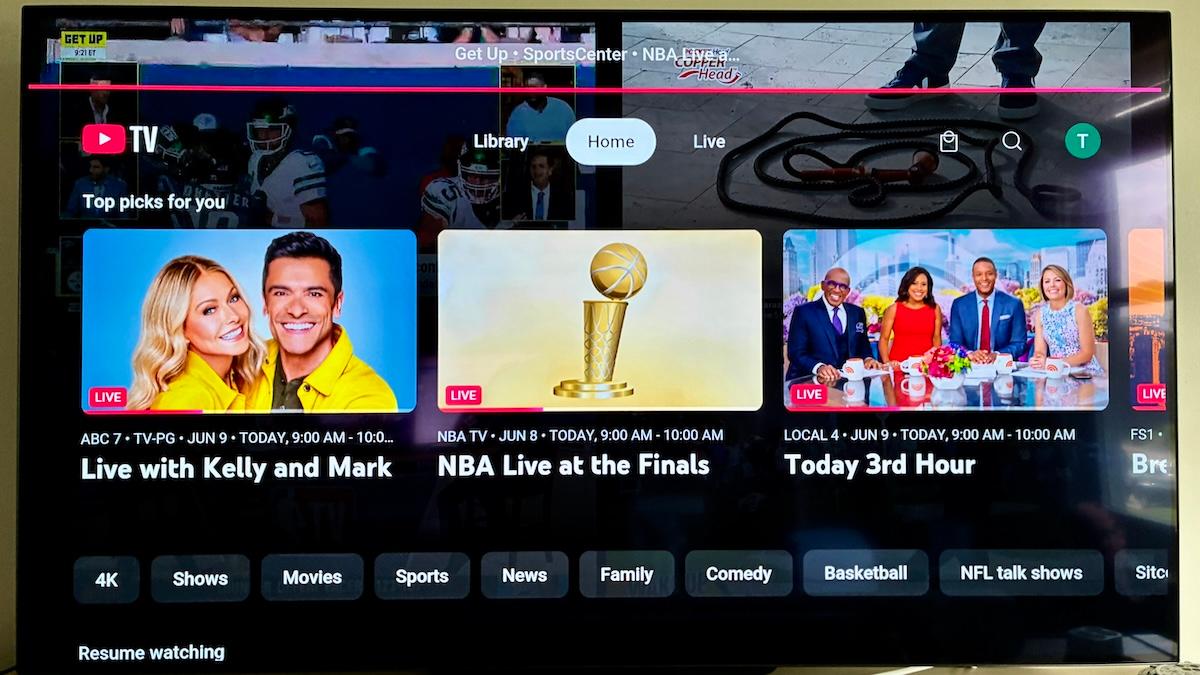

The catalyst for this shift isn’t a new technology, but the steady, silent and sensational growth of YouTube on Connected TV. By successfully transitioning from a mobile video site to the most-watched service on US televisions, surpassing even Netflix in total watch time, YouTube has proved that user-generated content and social algorithms don’t just work on a 6-inch screen; they thrive on a 55-inch one too.

Now, the rest of the social landscape seems to be looking to replicate that success. From TikTok’s widescreen optimisations to Instagram’s “Reels Channels” on Amazon Fire TV and X’s (Twitter) pivot into live broadcasting. The mission is clear, these platforms are no longer happy being the second screen we scroll through during commercials. They are launching dedicated Connected TV (CTV) applications to become the only screen, turning the center of the home into a personalised, AI-curated broadcast hub.

The Economic Engine: CPMs and Ad Real Estate

The rush toward Connected TV (CTV) isn’t just about prestige; it’s about a cold, hard financial reality: Not all eyeballs are priced equally. In the world of digital advertising, Cost Per Mille (CPM), the price to show an ad to 1,000 people, is the primary measure of value, and CTV CPMs are valued a lot higher than mobile CPMs as a result of how we engage with the devices.

On mobile, social ads often suffer from scroll fatigue, where a user might glance at a video for only three seconds before moving on. On TikTok, 2026 benchmarks show average in-feed CPMs (Cost Per Mille) hovering between $4.00 and $7.00. Instagram commands a slightly higher premium for its visually polished feed, with average CPMs around $8.00 to $9.50. While these platforms are masters of volume, the individual eyeballs on a 6-inch screen are priced as a commodity.

On television, the math changes entirely because CTV ads are typically viewed on a large screen in a lean-back state, often with sound and unskippable; these ads can have completion rates exceeding 90% and therefore command a larger premium. Current industry averages for CTV CPMs range from $30.00 to $45.00, with high-demand inventory on platforms like YouTube and Hulu spiking as high as $65.00.

For social platforms like Instagram, moving a viewer from a phone to a TV can effectively triple or quadruple the revenue generated from that same person’s attention.

The YouTube Tipping Point

Social media companies are chasing a milestone recently set by YouTube. In late 2025, a landmark shift occurred: major ad agencies reported that for many top-tier brands, YouTube ad spend on TV screens officially surpassed mobile spend for the first time. YouTube proved that by moving to the living room, a social platform could finally capture the brand awareness budgets – the billions of dollars previously reserved for the Super Bowl and prime-time sitcoms.

By launching CTV apps, platforms like X and Instagram are positioning themselves to take a bite out of the $60 billion traditional TV ad market. They are offering creators and brands the ultimate pitch: the immersive, cinematic reach of a 55-inch television, powered by the surgical, data-driven targeting of a social network.

(Source: Yahoo Tech)

The Big Three – Different Paths to the Living Room

While every social giant is chasing the same television ad dollars, they are taking wildly different approaches when it comes to the big screen experience.

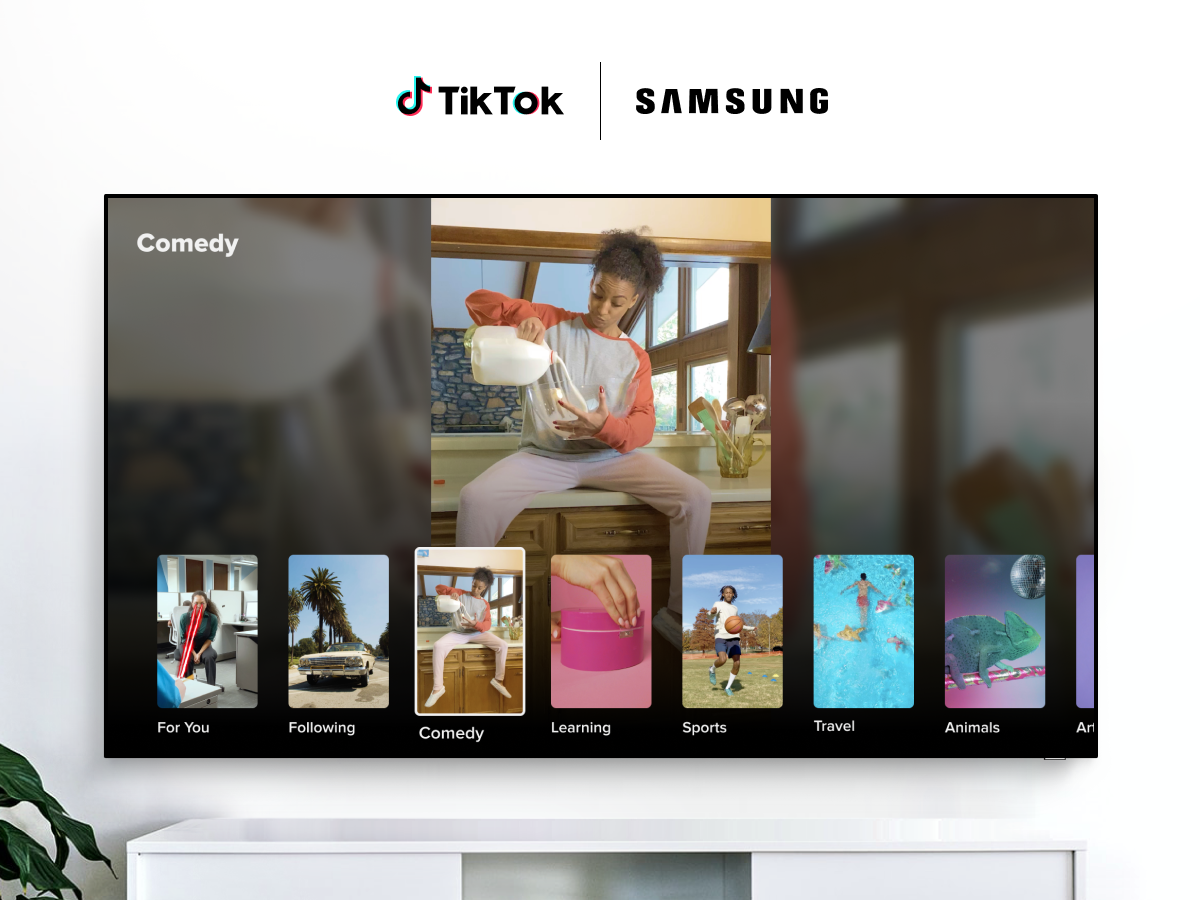

TikTok: The Lean-Back Algorithm

Although recently removed from Connected TVs, TikTok’s TV app was designed to eliminate the effort of social media. On a phone, TikTok is active; you swipe to find the next hit. On the TV app, TikTok became a linear channel. It auto-played a continuous stream of personalised content, essentially turning your television into a curated broadcast network that never ends. TikTok was clearly coming after Youtube, and incentivised its top creators to produce content that was horizontally shot and more than a minute long. Whilst the application was removed from Android TV and other platforms last year, I wouldn’t bet against them making moves back on to the Connected TV in the near future.

(Source: Samsung Newsroom)

(Source: Airmore)

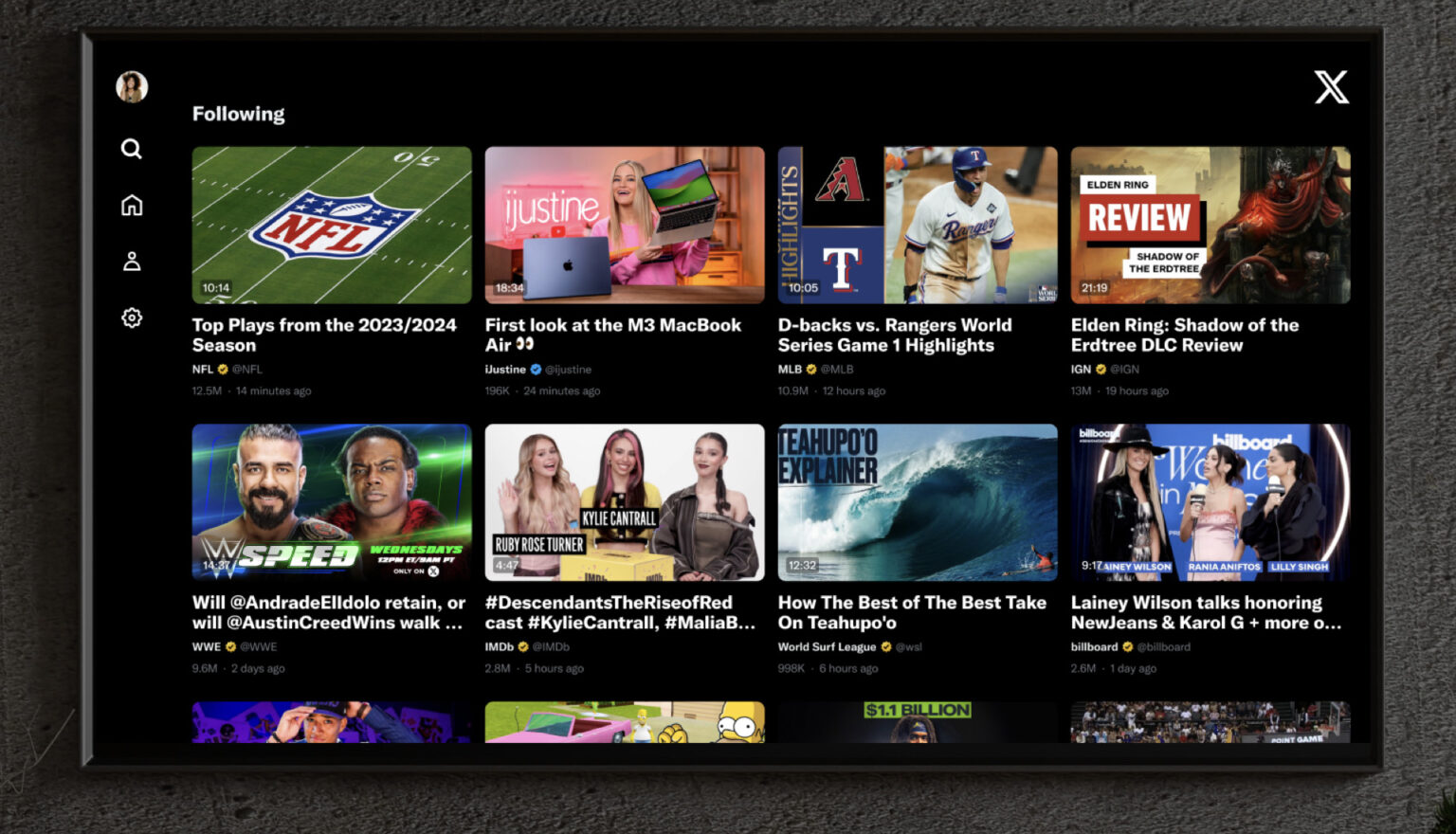

X (Twitter): The Big Media Strategy

Under Elon Musk, X is positioning its TV app not as a social feed, but as a direct competitor to YouTube and Broadcast/Cable TV. The X TV app features a trending video interface, a “Replay TV” service, and a focus on live events. By securing exclusive rights to long-form commentary and sports highlights, X is betting that users want appointment viewing, turning to the X app for breaking news and live sports the same way they once turned to CNN or ESPN.

(Source: TVB Europe)

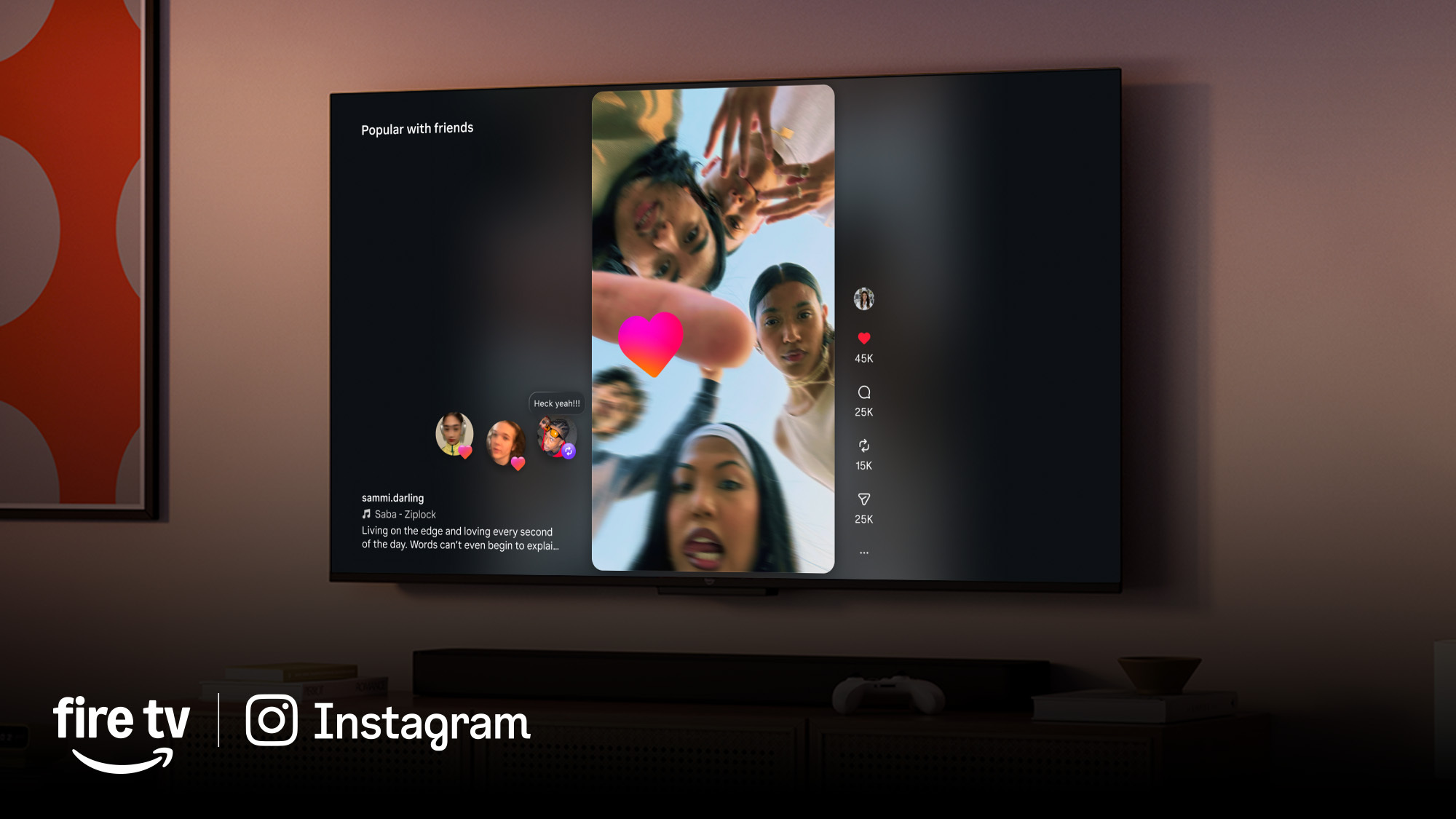

Instagram: The Discoverability Play

Instagram’s approach is more curated. Rather than a chaotic feed, their CTV pilot focuses on Topic-Based Channels that show Instagram Reels. Instagram is leveraging the TV as a discovery engine, assuming that if a family is sitting together, they want high-quality, aesthetically pleasing content that serves as background entertainment or inspiration for their next purchase.

(Source: TVB Europe)

The Content Evolution – From Phone-First to TV-Ready

The migration of social apps to the television isn’t just changing where we watch; it’s changing what is being made. For a decade, “social video” meant vertical, fast-paced, and raw. In 2026, the industry is witnessing a pivot as platforms incentivise creators to go horizontal.

Incentivising the Horizontal Frame

The most visible shift comes from the creators themselves. With YouTube now experiencing more watch time on Connected TV than any other platform, creators are incentivised to produce content that better suits this medium, being longer than one minute and, crucially, filmed in landscape mode.

If platforms such as Instagram follow suit, a generation of creators could be retrained to think about the big screen. This wouldn’t just be about aspect ratio; it would be about production value too, and I expect creators to increasingly invest in higher quality cameras and professional lighting to ensure their content looks professional when upscaled to a 75-inch living room screen.

The Rise of Serialised Storytelling

On the television, the “infinite scroll” is replaced by “lean-back” viewing. To keep viewers from reaching for the remote, creators are moving away from one-off viral clips and toward serialised storytelling.

Influencers are now structuring their content into “seasons” or multi-part documentaries, with topics such as car restoration and home rebuilding benefiting from the immersive nature of a TV.

This is a direct response to the YouTube CTV sensation, as platforms and creators have realised that 15 minutes of high-quality attention on a TV is more valuable than 100 three-second views on a mobile feed.

AI Upscaling and the Technical Bridge

Not all content is filmed for TV, but in 2026, it all has to look like it was. Platforms are also deploying AI-driven “Auto-Reframe” tools that allow creators to film once and instantly export versions optimized for both mobile and CTV. These tools use computer vision to keep the subject centered and high-resolution, in some instances even stretching a vertical shot to fit a widescreen TV without the fast aging black bars on either side of a portrait video.

The Living Room Dynamic – Co-Viewing and Shoppable TV

The transition from a 6-inch screen to a 55-inch one changes more than just the resolution; it changes the social context of the content. On mobile, social media is a solitary, high-speed activity. On Connected TV (CTV), it becomes a shared, lean-back experience that is opening up entirely new ways for creators and brands to sell.

The Return of Co-Viewing

According to research from Google and Ipsos, over 75% of people feel a deeper connection with friends and family when watching YouTube or social video together on a TV, and for platforms like Instagram, this co-viewing effect is a force multiplier. When a family watches a travel Reel or a DIY video together, a single stream generates multiple impressions. Advertisers are increasingly targeting these household moments, moving away from individual tracking toward household-level attribution, where a TV ad seen by the group could lead to a purchase made on an individual’s phone minutes later. To support this experience, platforms are introducing new methods to handoff between the CTV and a mobile device.

Frictionless Handoffs: The New Social Commerce

The biggest hurdle for TV has always been the absence of a “click”, and in 2026 the industry aims to solve this through frictionless handoffs to a second screen.

Rather than a static code in the corner of the screen, 2026 ads use Contextual QR overlays. If you’re watching a cooking show on the TikTok TV app, a QR code might appear specifically for the pan the chef is using, synced to your mobile TikTok Shop account. You may also have seen this more recently on the Amazon Prime Video app.

Instagram’s TV pilot includes a “Save to Mobile” feature. With one click of the TV remote, a product featured in a Reel is instantly sent to the user’s Instagram direct messages, allowing them to complete the purchase later on their phone without interrupting the TV experience.

Conclusion – The Algorithm is the New TV Guide

As we navigate 2026, the arrival of social media on Connected TV (CTV) represents the final stage of a decade-long convergence. We have moved past the era where “Television” and “The Internet” were separate entities. Today, the 55-inch screen in the living room is a powerful internet enabled, smart device.

The true disruption here isn’t just a change in screen size; it is the overthrow of the traditional TV Guide. For half a century, what we watched was determined by a handful of network executives and fixed time slots. In the CTV era, that power has shifted to the algorithm. Whether it’s YouTube auto-playing on a Samsung TV or Instagram’s interest-based Reels channels, the “Paradox of Choice” – that 20-minute struggle to find a movie on Netflix – is being solved by lean-back, hyper-personalized social feeds that know what you want before you pick up the remote. What’s more, I would expect these social platforms to become a primary source of content discovery for users of streaming applications such as Netflix. Research we recently conducted shows that social media is a source increasingly used by younger audiences to find that ‘next show’ to watch, and it’s not a stretch to think they’ll start to do this from their CTV as well as their mobile devices.

If you want to explore this shift in more detail, including how discovery behaviour differs by age group and platform, you can download the full research report here.

The Future: A Unified Attention Economy

For video based businesses and creators, the mandate for 2026 is clear: The mobile-only strategy is no longer a safe haven, and to capture the full value of the modern consumer, creators must produce content that is capable of being an intimate, vertical scroll on a phone at 8:00 AM and a long form, high-resolution broadcast on a TV at 8:00 PM.

Social media giants can crack the code of the living room by following the blueprint laid out by YouTube. By combining the trust and scale of the big screen with the precision and interactivity of social data they are building the next generation of global broadcasting. This feels like the beginning of the next decade of TV viewing.